November 2025

Featured Stories

Stay informed with the latest updates by following these important stories.

US government shutdown stalls import purchase decisions

The Port of Los Angeles heads into the holidays facing uncertainty as the federal shutdown stalls key trade data, leaving importers to make decisions without visibility ahead of the Lunar New Year rush. Executive Director Gene Seroka says retailers are pushing orders into Asian factories through December, creating a tight six-week cargo sprint. Even with that bump, year-end volumes may still fall short of last year’s tariff-driven frontloading. Still, the port is nearing a major milestone, 10 million TEUs in 2025, with October showing steady imports, a 7% rise in exports, and overall throughput holding just above long-term averages.

Slump of US imports from Asia deepening

According to new reporting from the Journal of Commerce (JOC), US import volumes are closing out 2025 in a deeper-than-normal slump as tariff-driven frontloading, softening consumer demand, and shifting trade policy weigh on retailer replenishment. Transport providers are feeling the pressure, with monthly imports unlikely to exceed 2 million TEUs through March, the JOC notes, citing the latest Global Port Tracker. Retailers continue to run lean inventories amid economic uncertainty, and forecasts now point to flat-to-declining container volumes in 2026 as consumer sentiment cools.

Europe ports lack buffer space to handle demand surges

A new Journal of Commerce (JOC) report highlights how Europe’s persistent port congestion is exposing the region’s limited buffer capacity — from constrained terminal space to strained inland networks. Despite recent signs of easing, major hubs like Antwerp, Hamburg, and Rotterdam remain heavily disrupted as structural undercapacity, larger vessels, shifting peak seasons, labor actions, and alliance reshuffling continue to overwhelm operations. Analysts say long-term infrastructure expansion is underway, but short-term relief is unlikely, pushing shippers to extend lead times and diversify routings as congestion cycles persist across Europe.

‘Ugly’ fees on Chinese ships concern US ag exporters

This Freightwaves report highlights industry pushback against the now-paused U.S. fees on Chinese-built and Chinese-owned ships. Agriculture Transportation Coalition executive Peter Friedmann argues the charges — which cost Cosco and OOCL an estimated $42 million in their first week — risked raising exporters’ costs without meaningfully boosting U.S. shipbuilding. Although Washington and Beijing agreed to suspend the reciprocal fees for a year, Friedmann warns they would have ultimately made U.S. farm goods less competitive. The article also notes China’s sluggish soybean purchases and ongoing concerns among exporters, even as broader U.S. shipyard modernization proposals, such as the SHIPS Act, gain attention and new foreign investment flows into U.S. maritime infrastructure.

Supreme Court questions Trump’s tariff powers in landmark case

A Supply Chain Dive report highlights sharp skepticism from Supreme Court justices as they weigh President Trump’s use of the International Emergency Economic Powers Act to impose unlimited “reciprocal tariffs.” During more than two hours of arguments, multiple conservative justices questioned whether IEEPA’s language, particularly “regulate ... importation,” can legally authorize broad tariffs, noting Congress has never used the statute this way. The plaintiffs, a coalition of states and small businesses, argue the tariffs bypass Congress’s constitutional authority and would cause significant financial harm. With two lower courts already ruling against the administration, a Supreme Court loss could trigger billions in tariff refunds and cast doubt on trade deals built on IEEPA-based duties. The Court gave no timeline for a decision.

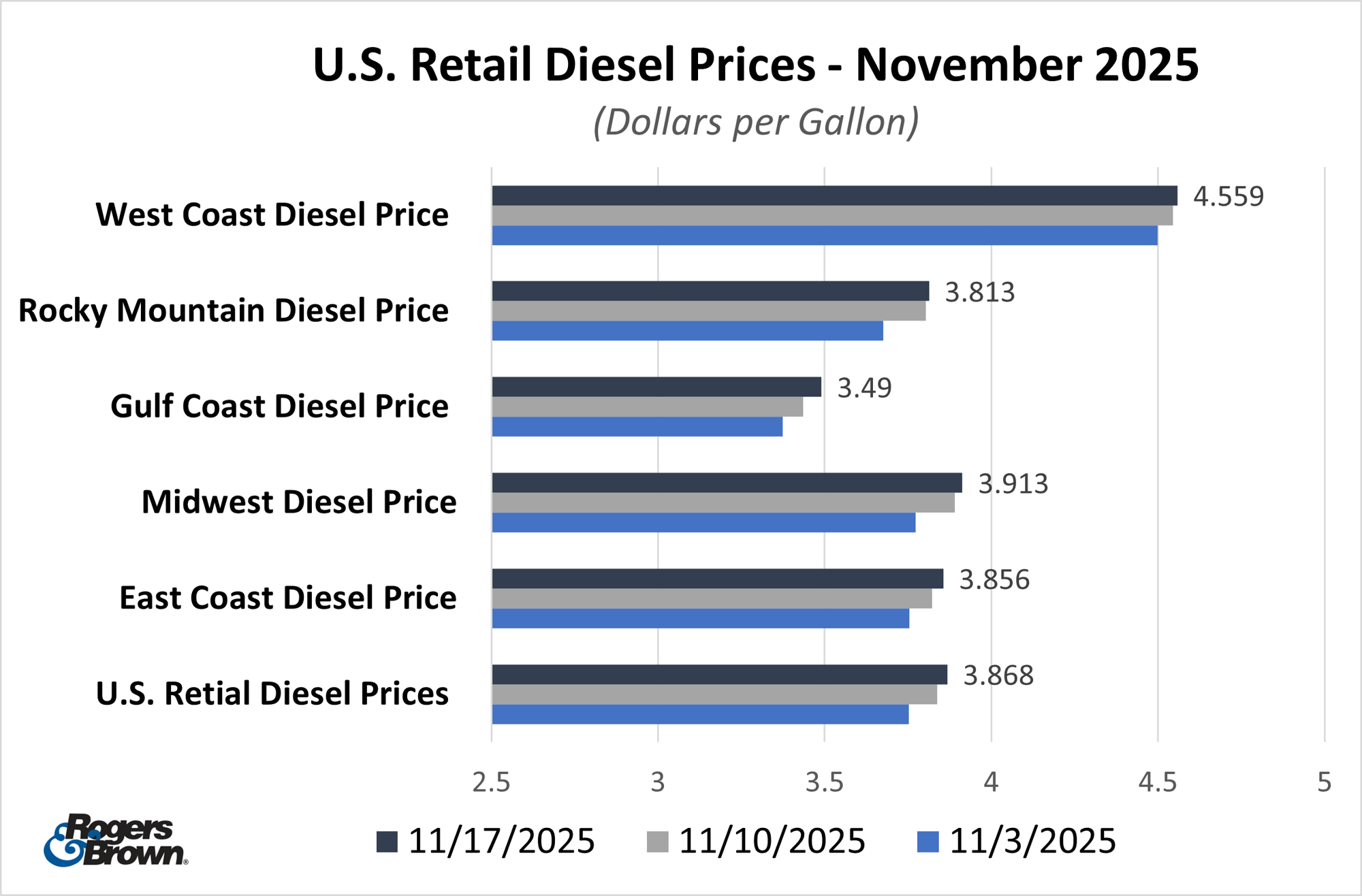

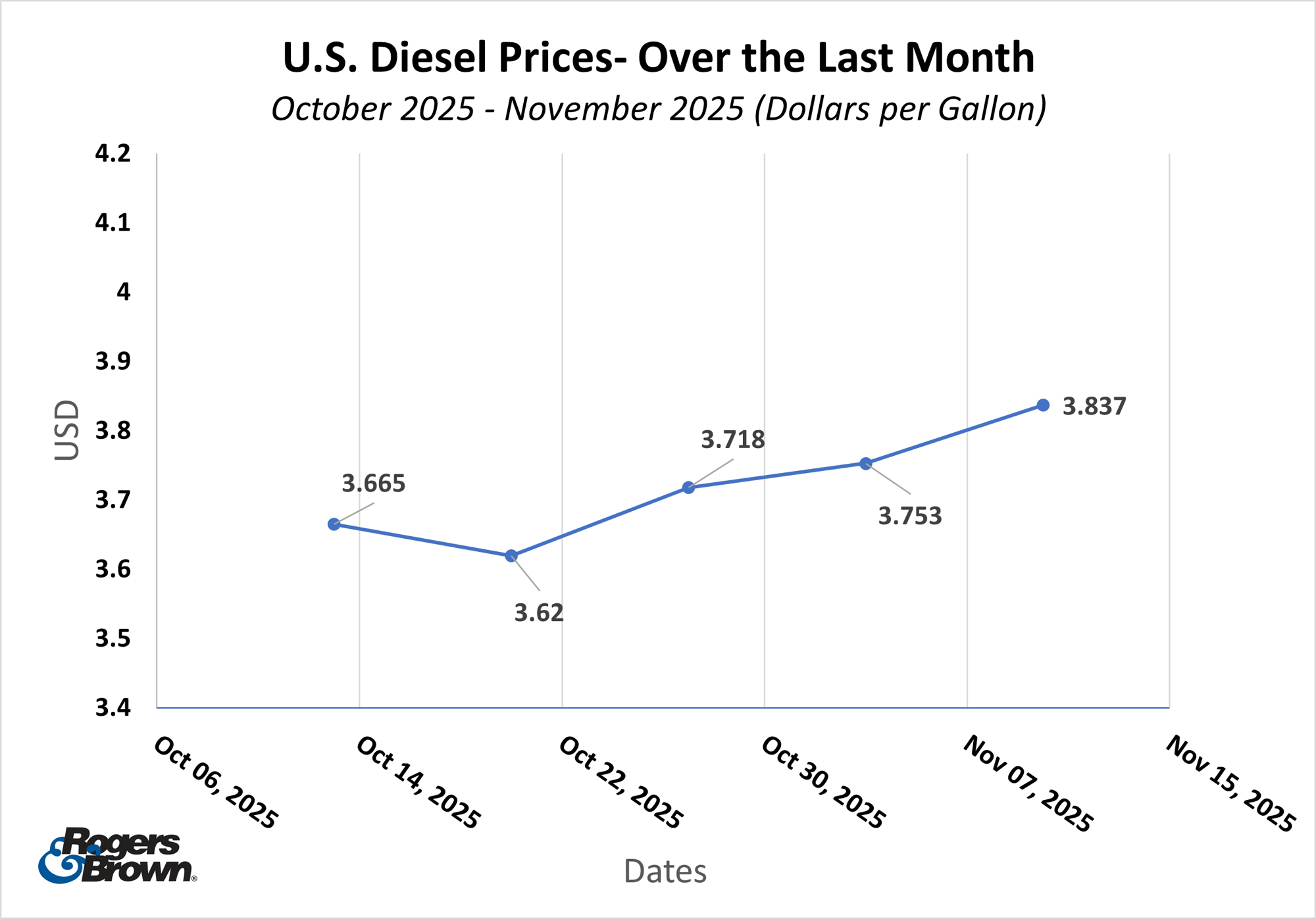

EIA Diesel Prices

U.S. On-Highway Diesel Fuel Prices (dollars per gallon)