August 2025

Featured Stories

Stay informed with the latest updates by following these important stories.

Steel, Aluminum Tariff Expansion "Unwelcome News" for Transport Providers

The Journal of Commerce reports that the White House’s August 15 decision to dramatically expand steel and aluminum tariffs is set to ripple across global trade and transportation. The expansion added 407 new HTS codes — covering more than $160 billion in goods — and will raise costs for industries ranging from furniture and construction equipment to rail and trucking. With furniture imports already declining and capital goods such as bulldozers, farm equipment, trailers, and railway parts now facing sharply higher effective tariff rates, the impact is expected to dampen import demand and increase equipment costs. According to the Journal of Commerce, these developments create new headwinds for transportation providers already contending with a prolonged freight market downturn.

Tariff Jitters Spark Jump in USMCA Claims on Mexico, Canada Goods

FreightWaves reports that U.S. businesses are increasingly turning to United States-Mexico-Canada Agreement (USMCA) exemptions as rising tariffs on steel, aluminum, and copper drive up import costs. In June, the share of Canadian goods classified as USMCA-compliant jumped to 81% from 56% the month before, while Mexico’s share rose to 77% from 42%, according to U.S. Customs and Border Protection data. Logistics providers note a surge in inquiries as companies seek relief from tariffs that now cover 400 additional product types, including appliances, vehicle parts, and aluminum cans. Analysts project even higher USMCA compliance in 2025, though businesses face significant documentation requirements to qualify.

Trump Tariffs: Tracking the Status of International Trade Actions

Supply Chain Dive reports that President Trump’s return to office has brought a wave of tariff actions and trade reviews, creating a shifting and often unpredictable trade landscape for businesses and foreign governments. Since January, the administration has implemented new reciprocal tariff policies, country-specific rates, and agreements with major partners, including the EU, Japan, and South Korea, while also managing a fragile truce with China. Ongoing legal challenges, including a federal court injunction against certain tariffs, add further uncertainty. To help companies navigate these rapid changes, Supply Chain Dive is maintaining an updated tracker of U.S. and foreign tariff actions.

US, EU Agree to Terms of Framework Trade Pact

Supply Chain Dive reports that the U.S. and European Union have formalized the framework trade agreement announced in late July, outlining new tariff structures and market access commitments. Under the deal, the U.S. will impose a 15% tariff on most EU imports or the higher most favored nation (MFN) duty rate, while capping tariffs on pharmaceuticals, semiconductors, and lumber. The EU, in turn, plans to eliminate tariffs on U.S. industrial goods and expand access for American food exports. The agreement also includes provisions for cooperation on auto standards, potential coordination on steel and aluminum overcapacity, and major EU commitments to purchase U.S. energy and AI chips. Officials from both sides said the deal aims to bring stability and predictability to transatlantic trade.

Trade Export Predicts 200% Surge in Tariff-Fraud Crackdowns

FreightWaves reports that as the latest round of Trump administration tariffs takes effect, trade expert Rennie Alston is warning importers of heightened compliance scrutiny from U.S. regulators. Speaking at a supply chain summit, Alston said the Department of Justice is increasingly stepping in on customs violations, with tariff circumvention expected to become the top source of penalties. Importers face closer inspections of valuation, origin, and transshipment practices, with tactics like Modified Delivery Duty Paid flagged as fraudulent. Alston cautioned that penalties could far exceed the value of the goods, urging companies to prioritize strict compliance amid rising tariff enforcement.

.png)

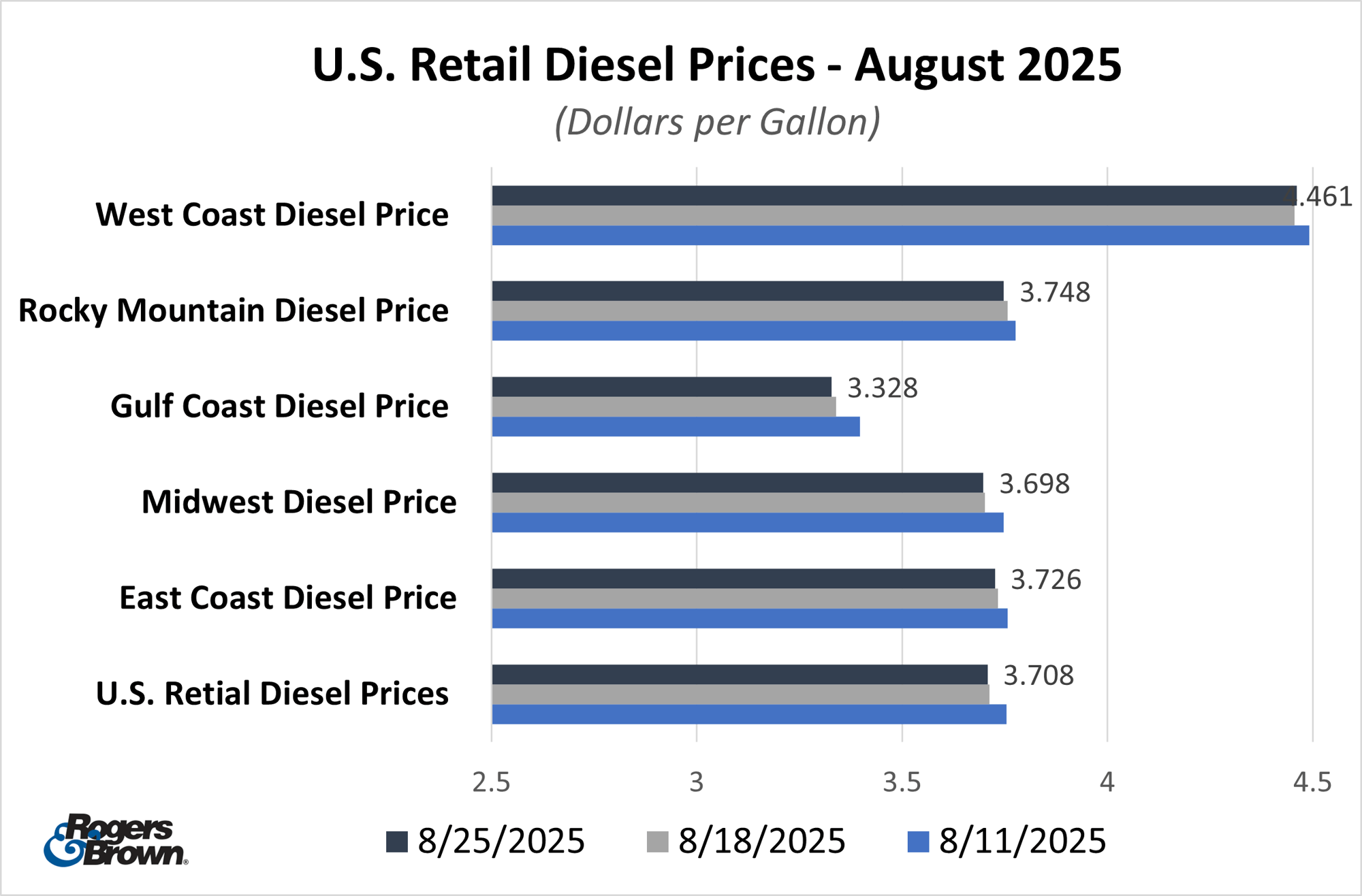

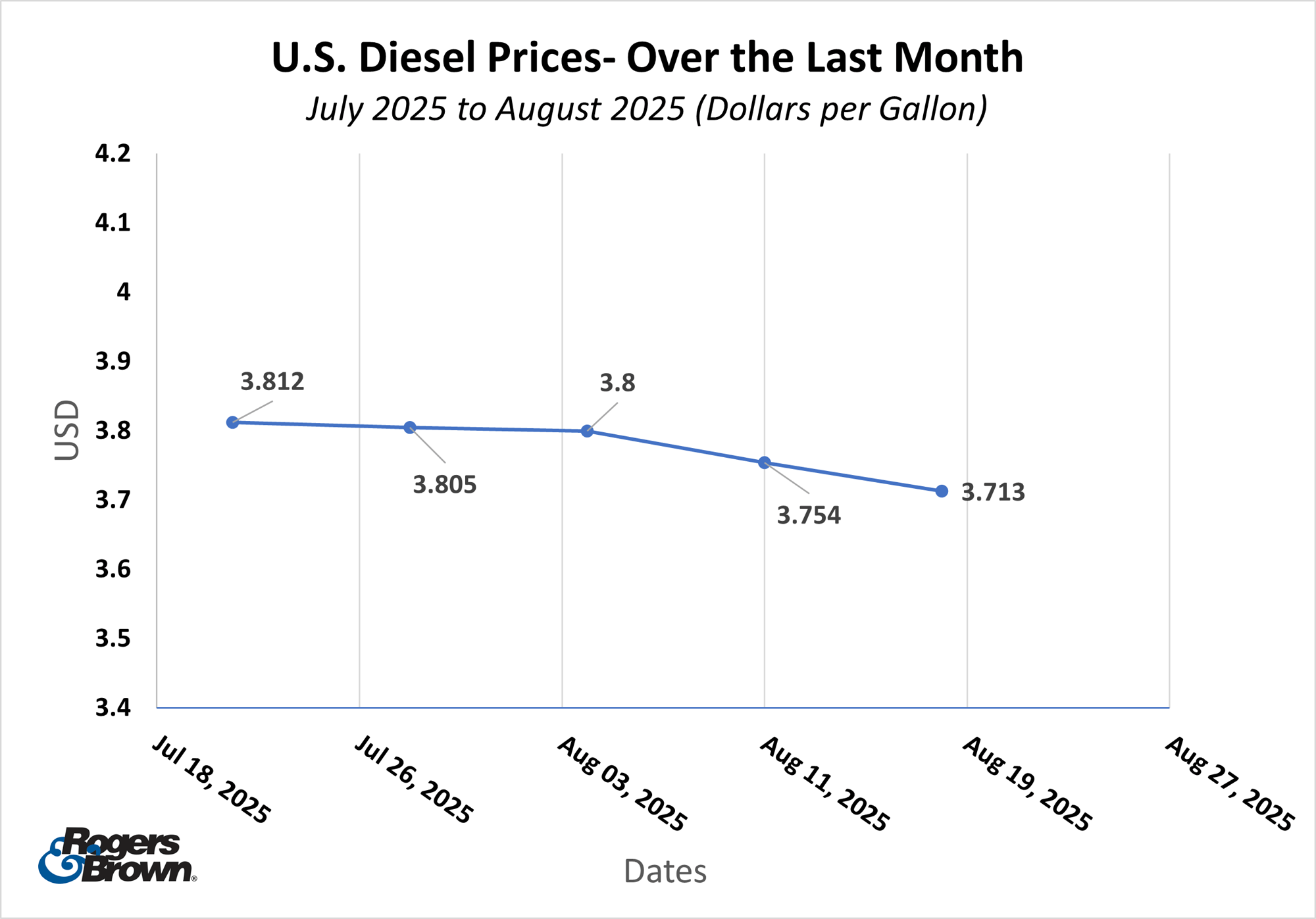

EIA Diesel Prices

U.S. On-Highway Diesel Fuel Prices (dollars per gallon)

-1.png)